Some Known Facts About Home Renovation Loan.

Some Known Facts About Home Renovation Loan.

Blog Article

The Buzz on Home Renovation Loan

Table of ContentsThe Single Strategy To Use For Home Renovation LoanHome Renovation Loan Things To Know Before You Get ThisRumored Buzz on Home Renovation LoanHome Renovation Loan Can Be Fun For AnyoneHome Renovation Loan for BeginnersLittle Known Questions About Home Renovation Loan.

If there are any overruns, you'll need to spend for them on your own. That's why we recommend placing money aside. You'll likewise have to show invoices for the work and send a last evaluation record to your economic establishment. You may desire to purchase loan security insurance coverage to minimize the dimension of your down settlement.Refinancing can be helpful when the restorations will certainly include worth to your home. By boosting its value, you boost the chance of a roi when you offer. Like all funding choices, this has both advantages and drawbacks. Advantages: The rate of interest is normally less than for other kinds of financing.

Similar to any kind of line of credit, the cash is readily available in all times. The rate of interest are usually lower than for many various other sorts of financing, and the interest on the credit rating you have actually used is the only point you need to make certain to pay on a monthly basis. You can use your credit limit for all sorts of projects, not simply improvements.

6 Easy Facts About Home Renovation Loan Described

These are both useful methods to fund tiny jobs. Unlike the previous alternatives, these 2 don't involve your home. Benefits of a credit line: A debt line is versatile and gives fast accessibility to cash. You can restrict your regular monthly settlements to the rate of interest on the debt you have actually made use of.

Benefits of a personal car loan: With an individual financing, you can pay off your improvements over a predefined period. Considerations: When you've paid off an individual lending, that's it.

Home Renovation Loan - An Overview

, so you may be able to lower your expenses this means. You'll have to make certain the monetary help and credit scores are still being offered when the work begins and that you satisfy the eligibility criteria.

Want to make certain your means match your ambitions? Talk with your expert, that will certainly assist you select the option that fits you ideal. By comparing the two, you'll see just how large a regular monthly lending payment this article you can make for the improvements.

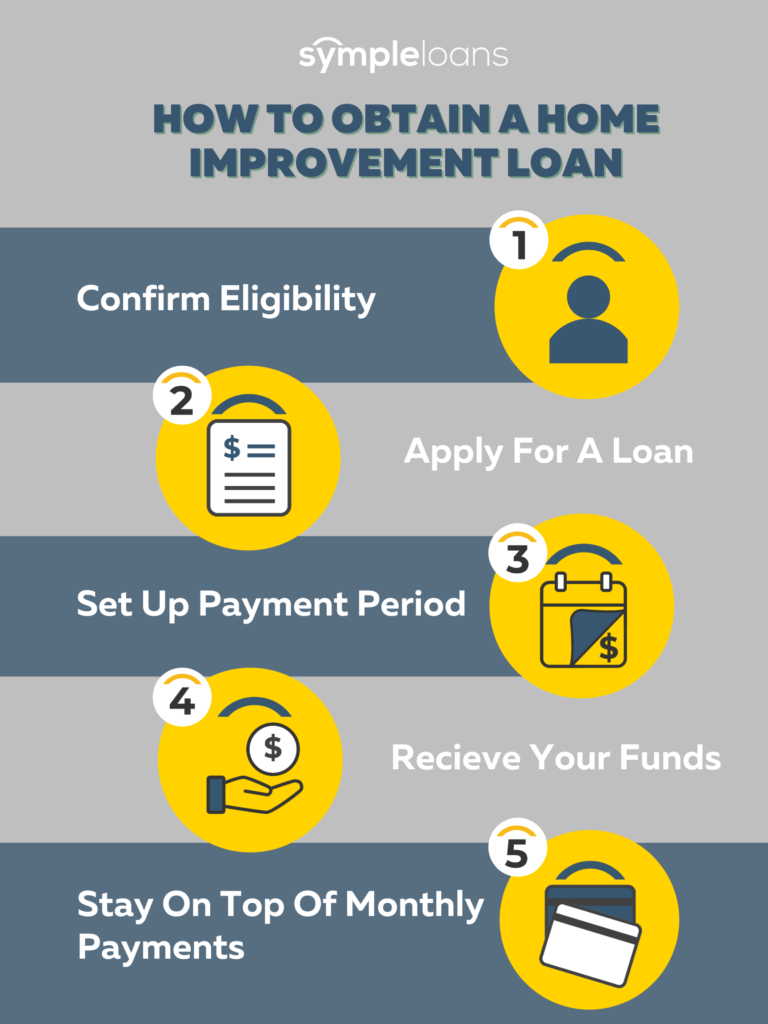

There are numerous factors to refurbish a home, yet many home owners do so with the intent of increasing their home's worth must they decide to sell in the future. Funding home remodelling jobs with home restoration loans can be a wonderful method to lower your costs and improve your roi (ROI). Below are a couple of specific benefits of home renovation financing.

Indicators on Home Renovation Loan You Should Know

This might not be a huge offer for smaller sized improvements, yet when it involves long-lasting jobs, charge card financing can rapidly get expensive. Home renovation lendings are a more cost-efficient solution to making use of bank card to spend for the products required for home restorations. While interest prices on home remodelling car loans vary, they tend to be within the variety look at this website of Prime plus 2.00 percent (presently, the prime rate is 3.00 percent).

There are also several various terms offered to match every job and budget. If you need the funds for a single task, an equity finance with a fixed regard to 1 to 5 years may be ideal fit your needs. If you need more adaptability, a credit line will certainly allow you to obtain funds as needed without requiring to reapply for credit rating.

Have your home examined by an EnerGuide power expert. Once the job has actually been done, your home will certainly be assessed again to validate that its power performance has actually improved.

In enhancement to government programs, take some time to inspect out what's offered in your province. There might be money just waiting for you to declare it. Below's an overview of the major home improvement grants by province.

Home Renovation Loan Fundamentals Explained

Homeowners can additionally conserve when they upgrade to a next-generation thermostat. If you live in the Northwest Territories, you can use for a money discount on all kinds of products that will certainly help reduce your energy consumption at home.

If you possess a home here, you might be qualified for refunds on high-efficiency home heating devices. Discounts are likewise available to house owners who see page upgrade their insulation. After a home power examination is performed. What's more, there are motivations for the acquisition and installation of solar panels and low-interest lendings for improvements that will make your home extra energy reliable.

The quantity of economic support you might get differs from under $100 to several thousand dollars, depending upon the job. In Quebec, the Rnoclimat program is the only method to access the Canada Greener Houses Give. The Chauffez vert program supplies incentives for changing an oil or propane heating system with a system powered by renewable resource such as electricity.

The Of Home Renovation Loan

Saskatchewan only provides incentive programs for companies - home renovation loan. Watch out for brand-new programs that might also put on home owners. The Yukon federal government has a generous schedule of programs to help homeowners with home enhancement projects. For instance, house owners can look for up to $10,000 to change insulation in the walls, foundation, or attic.

There are various other incentives for points like replacement windows, warmth healing ventilators, and next-generation appliances. Restorations can be stressful for households. It takes cautious planning well before the job begins to avoid undesirable surprises. When creating your remodelling spending plan, keep in mind to consider completely you can conserve money.

Report this page